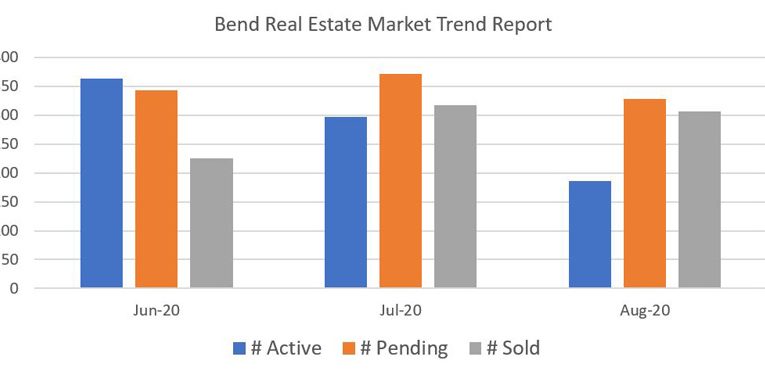

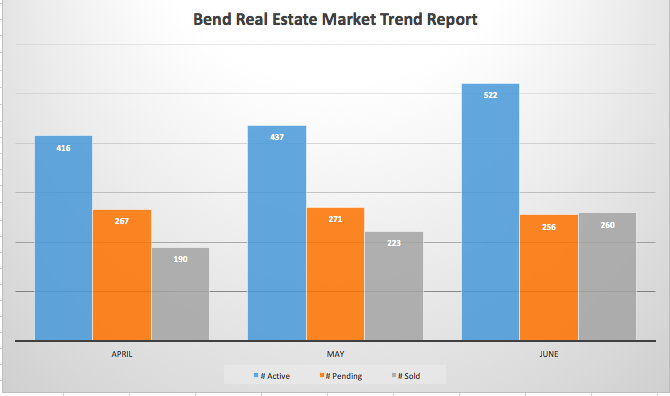

Duke Warner Trend Report for June 2020

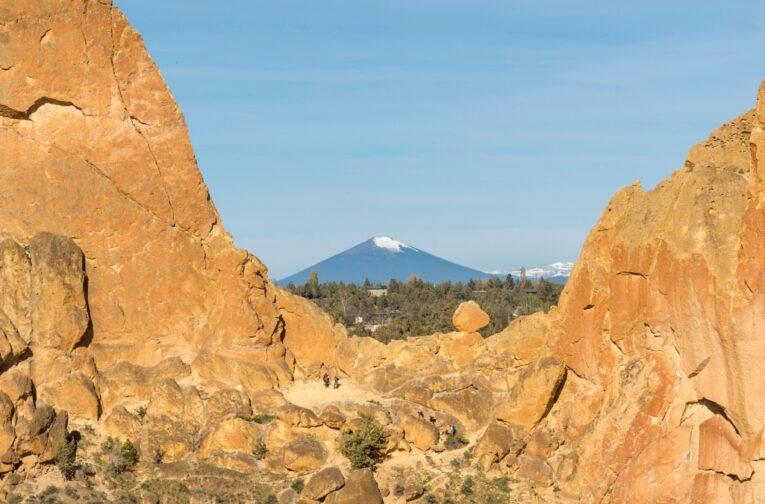

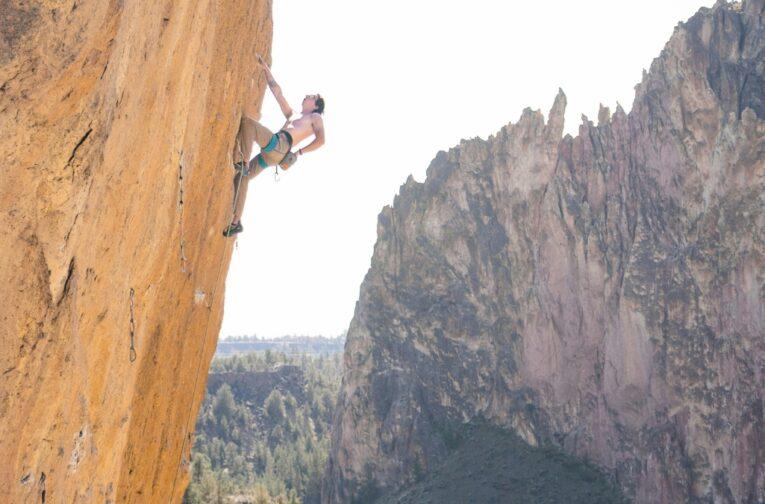

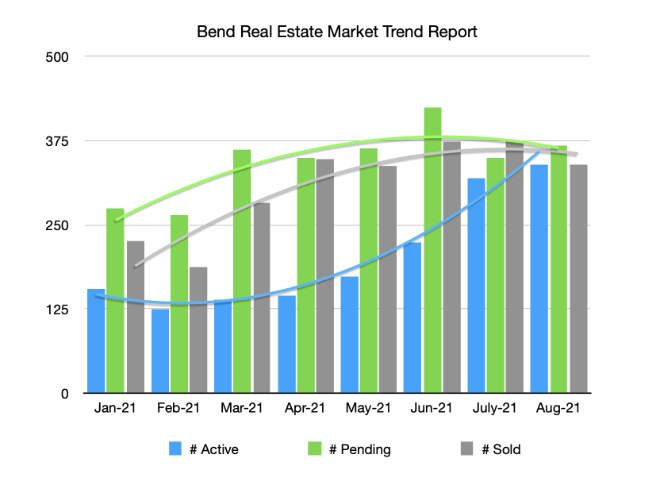

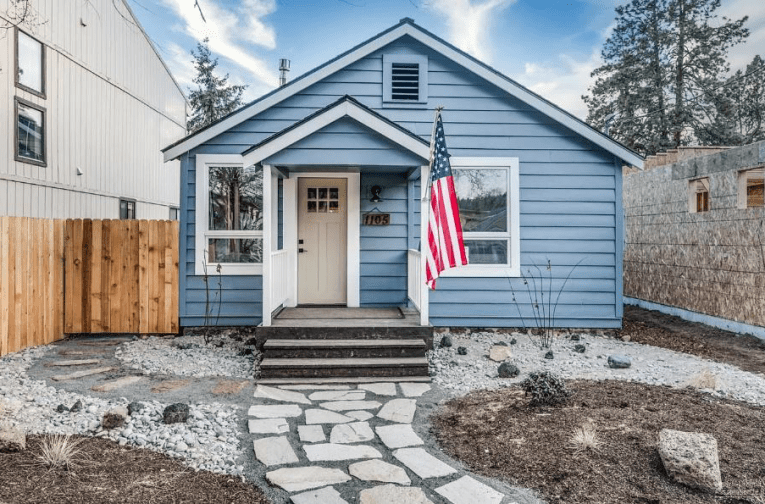

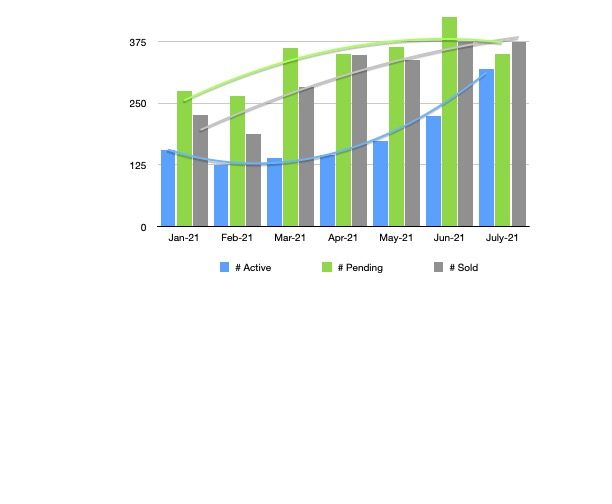

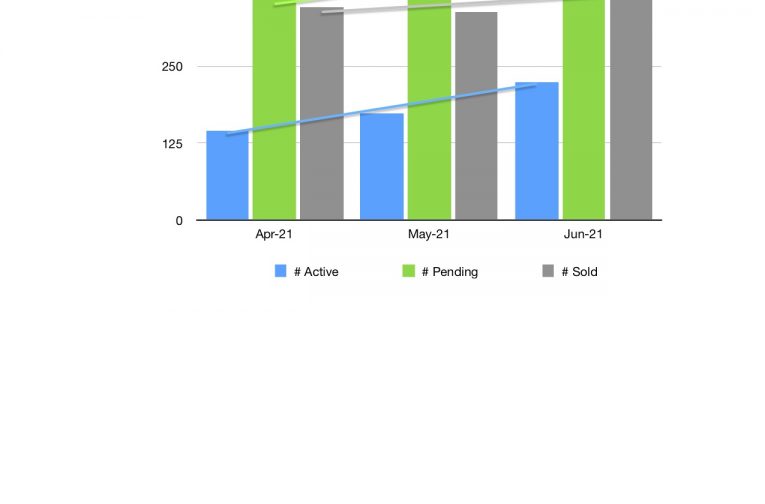

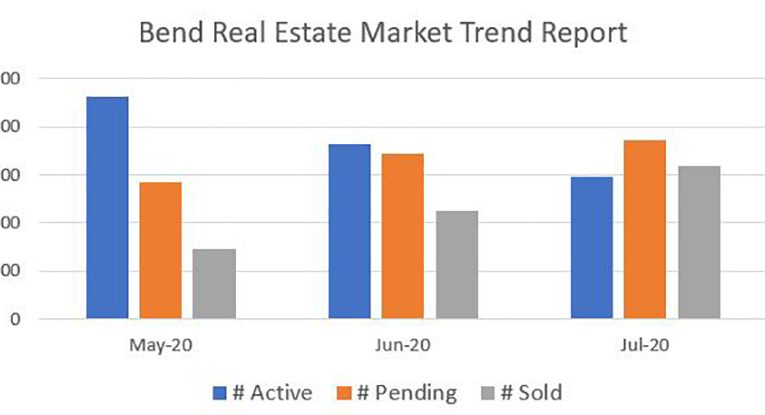

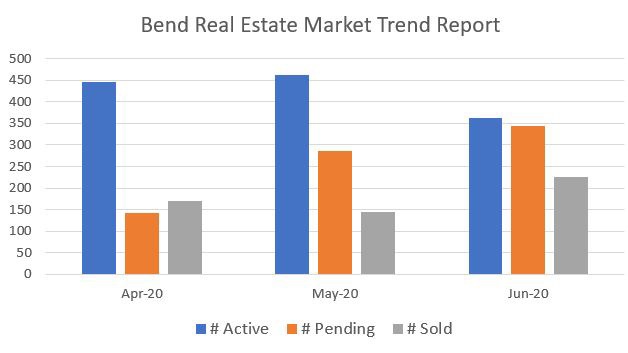

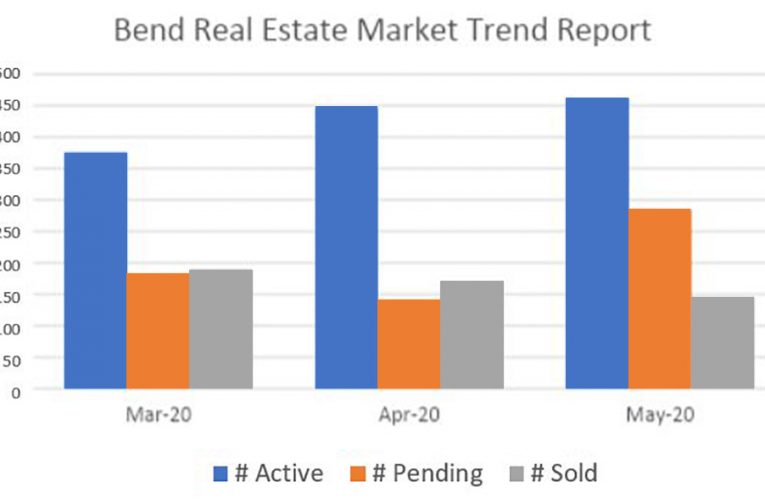

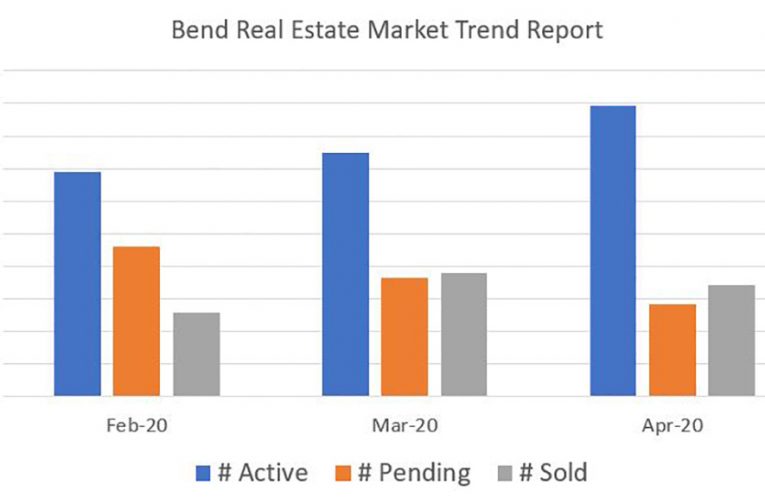

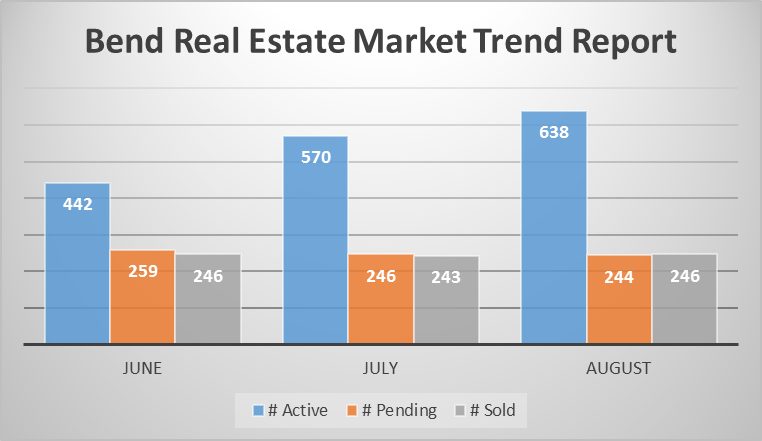

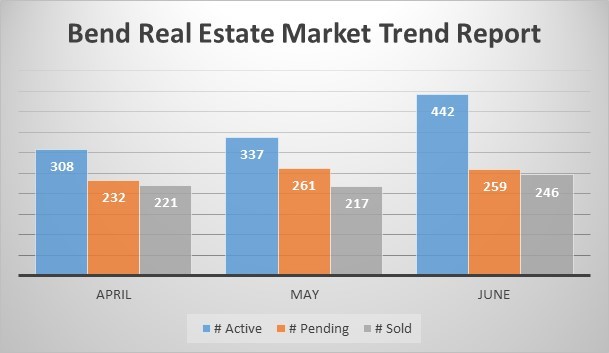

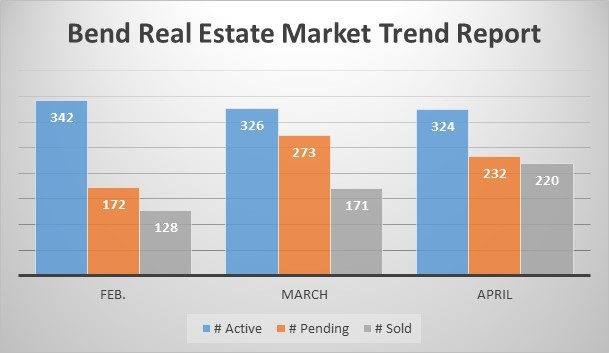

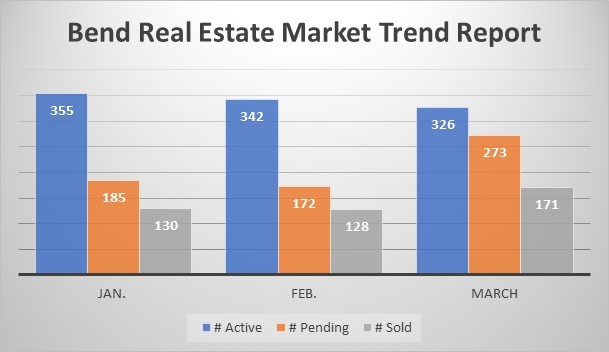

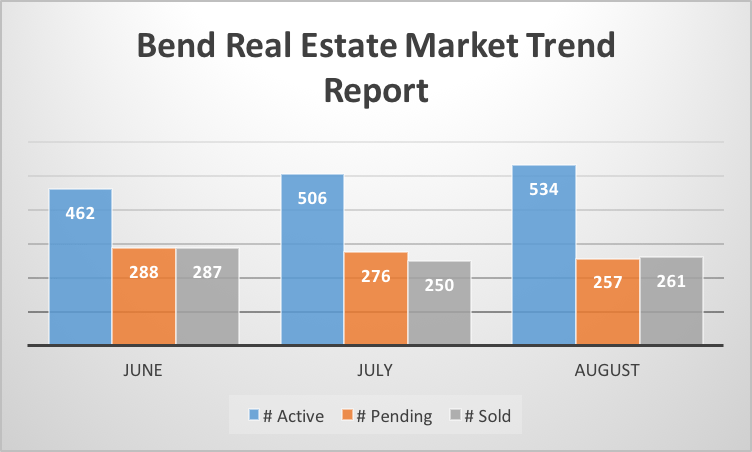

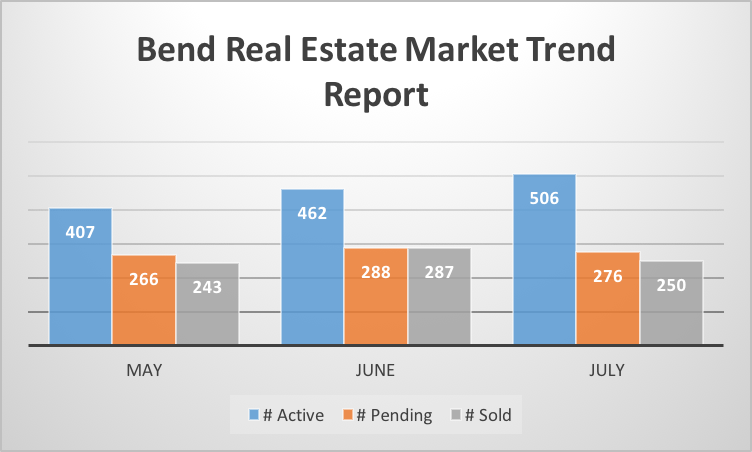

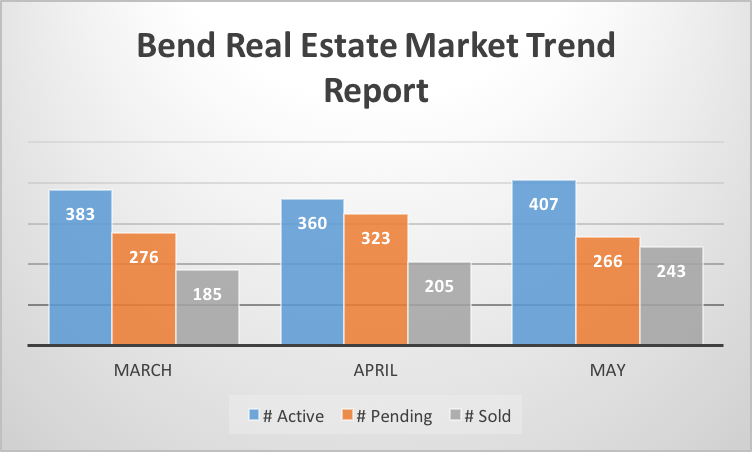

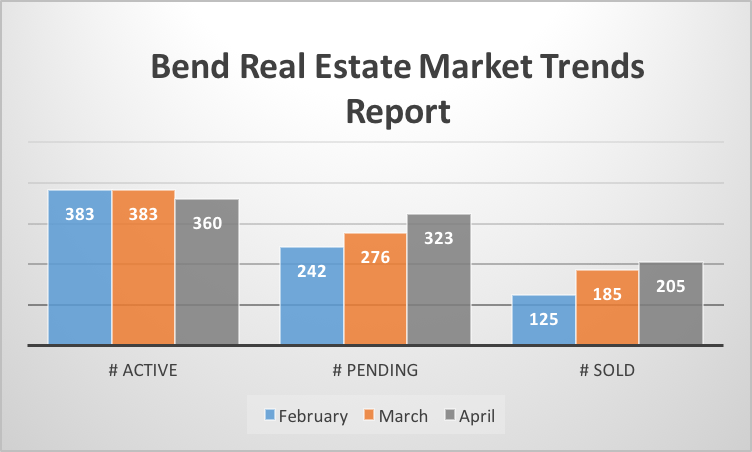

Living in Central Oregon certainly has its advantages. Beautiful lakes, crystal clear rivers, abundance of sunshine, great craft breweries, sunshine (did we mention this previously?), and a bustling real estate market. If you have ever considered leaping into homeownership in Bend, OR, there is no better time than the present. Our monthly report provides our compiled, “boots on the ground,” data regarding the real estate market in stunning Central Oregon. The one fact that jumps out at us- the housing market is still the most reliable investment you can make for the future. Our June predictions were defined as strong, as we stated. We foresee finishing strong in July, as well. Here are our latest findings from the previous month.

Pay More for a Mortgage? | Bend, Oregon Real Estate

When purchasing a home, a question that occasionally comes up is whether or not it is worth it to pay more for a mortgage in Bend, Oregon. Let us explore the options. In many cases buyers do quite well to obtain the cheapest possible mortgage. However, in some situations buyers may find that paying a little bit more is well compensated by how their needs and circumstances are addressed with extra service. Let us examine several of these situations. If any of these seem to fit for you, consider talking to your broker at Duke Warner. With decades of experience in the local market, we are well versed in helping our clients ascertain if the extra money spent may be worth it in particular situations.

Everything You Need To Know About Mortgages

Private Mortgage Insurance

A key issue that comes up for some borrowers is Private Mortgage Insurance (PMI). In general this is required on loans which do not meet the minimum 20% down payment in order to insure the lender against possible default. Many buyers manage to find creative ways of coming up with the 20 % down, but this is not always possible. If that is the case, some lenders do offer other options. One of these is the possibility of self-insuring via the offering of a higher interest rate. While this will result in a more expensive mortgage, it can be a way into a home for some buyers.

Another situation is if you need significant flexibility with the overall timeline of the transaction, like the capacity to either advance or delay it. For example, it is not uncommon for a buyer to be selling an existing home during the same period. So the closing on the new home may actually be contingent on the sale of the home that is currently owned. In this circumstance, a lender who is willing to accommodate the vagaries of the process may be well worth the slightly higher interest rate or fees.

(more…)